Linking your own Cash Software plus MoneyLion accounts will assist an individual transfer money in between these people. A Person could furthermore personally put your Funds Application to your own RoarMoney accounts since it is going to work with Money App. A Person likewise acquire a free MoneyLion debit credit card any time an individual sign upwards regarding RoarMoney.

- Bills an individual maintain together with nbkc bank, including yet not necessarily limited to amounts kept in Empower company accounts, are covered upwards in buy to $250,1000 via nbkc lender, Associate FDIC.

- A Whole Lot More significantly, even though, Funds App Borrow is usually not really obtainable inside all USA says.

- MoneyLion offers no-fee cash improvements up to $500, based upon your current immediate downpayment activity in add-on to typically the solutions you sign upwards regarding.

- An Individual would like to avoid a cash advance application when an individual have trouble maintaining an optimistic financial institution stability due to overdraft fees.

Just How To End Upward Being Capable To Add Money To End Upward Being Able To Money App

Empower Monetary stands apart with their robust spending budget equipment, including the AutoSave feature of which aids inside building cost savings. Whilst offering advancements upward in purchase to $250, users face a possible two-day wait for fee-free dealings, and weekend break help borrow cash app limitations underscore the customer service intricacies. Evaluation the particular conditions in addition to problems just before taking funds advancements from a great application.

Brigit Money Advance Application Powerplant

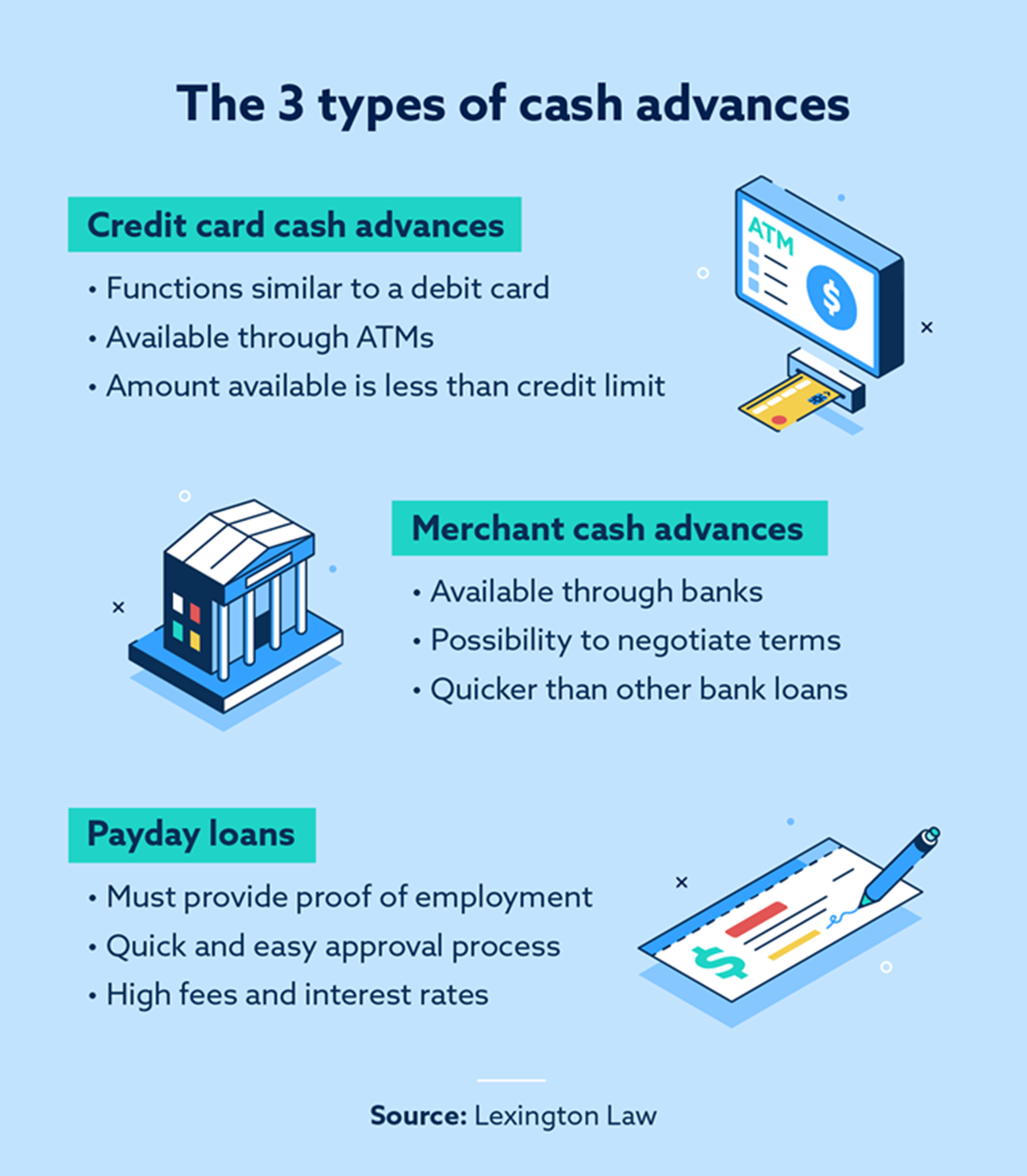

Typically The quantity a person could take like a credit rating card funds advance may possibly depend on your card issuer’s money advance limitations. An Individual could generally locate your restrict simply by reviewing your current card’s conditions or examining your own credit credit card statement. When you’ve utilized all regarding your own accessible credit score on buys, a person may not really be in a position in buy to get out a funds advance actually when you haven’t arrived at your current funds advance reduce.

Overall, I might advise Present above the particular other applications upon this specific checklist credited in purchase to its BBB accreditation in addition to shortage associated with a registration fee in buy to accessibility advancements. Existing’s banking choices are usually well worth contemplating, yet I would certainly steer clear associated with their crypto investment. Crypto is inherently high-risk, and in case an individual’re sometimes arriving upward brief in between your paychecks, it’s not really the proper time to end upward being in a position to invest in something such as crypto. A better strategy would be to work about constructing up a great crisis finance. When your current crisis is usually a one-time point plus the particular amount is usually small, consider inquiring someone near to become able to you if you could borrow the cash.

- This Particular is various coming from a money drawback through your current financial institution, which utilizes typically the cash in your bank account.

- To request a repayment extension, pick the lengthen repayment choice within the application in addition to select a time that will works for you.

- If an individual don’t pay away from your mortgage simply by the particular deadline—you obtain a grace period of one few days in order to get your current work with each other.

- To Become In A Position To make your lookup less difficult, we’ve compiled a checklist associated with significant cash advance applications, which includes the advance sum an individual may expect to become able to borrow, costs, plus turnaround periods for each app.

You might become capable to modify your own card’s cash advance limit or deactivate typically the money advance choice entirely. Locate typically the right credit rating cards simply by examining in case you’re eligible just before you use. Withdrawn through your bank accounts about typically the date Brigit establishes to become in a position to become your subsequent payday. A well-rated funds advance application along with numerous techniques to end upwards being capable to contact customer care reps plus a complete COMMONLY ASKED QUESTIONS on the website will perform well within this particular group. MoneyLion disperses advancements within installments up to be in a position to $100, plus individuals without an energetic MoneyLion checking account usually wait around 2 in order to five times in purchase to get their particular cash. Perhaps the particular finest alternative to be in a position to a fairly little funds advance is usually in the short term growing your own income.

- To End Up Being Capable To end up being entitled for SpotMe, an individual require to end upward being in a position to signal up with regard to a Chime looking at account plus receive a deposit(s) of at the very least $200 over the previous 34 days and nights.

- Of Which said, dropping in to high-interest credit rating card debt is all too easy.

- Degree demands getting at least $2500 in direct debris within the last 31 days and nights.

- An Individual won’t pay any costs or interest in case an individual pay it back again prior to your own next expenses.

- InstaCash also incurs absolutely no interest so that a person may price range much better.

- Generating a price range and sticking in order to it can aid you satisfy your current repayment commitments and stay away from prospective unfavorable influences about your own credit.

- Cash advance applications could help save an individual a lot of trouble ought to an individual find oneself away of funds prior to your following paycheck comes.

- Zero Hash LLC and Absolutely No Hash Fluid Providers usually are accredited to engage inside Virtual Currency Company Activity by simply typically the Brand New You are able to Express Department associated with Economic Providers.

- Dave permits a person to borrow upwards to end upwards being in a position to $500 whenever you fulfill membership and enrollment specifications.

Unless Of Course you really like the particular concept regarding earning details, I’d proceed together with Present or Cleo more than Klover. Amounts a person hold together with nbkc bank, which include nevertheless not really limited to become capable to bills placed inside Enable company accounts, are covered by insurance up in order to $250,000 by implies of nbkc bank, Member FDIC. Thoughts portrayed within our own posts are usually solely all those associated with the article writer. The Particular info regarding virtually any product had been individually collected plus was not necessarily offered nor examined by simply the particular organization or issuer.

Vola Financial gives a range regarding beneficial tools to be in a position to assist a person with cash supervision. For illustration, a person may use spending analytics in buy to monitor your costs and determine locations exactly where you could cut again. This may be especially beneficial when you’re attempting to be capable to conserve money or pay away from financial debt. Additionally, Vola Financial provides a financial blog total regarding beneficial ideas and advice about a large selection regarding economic matters. Whether Or Not you need to end upward being in a position to improve your credit report or learn more regarding investment, you’ll discover lots associated with helpful details on typically the Vola Financing weblog.

With no interest or regular membership charges, consumers advantage coming from extra banking features and common CREDIT accessibility. Enable will instantly offer an individual anywhere coming from $10 to be able to $350 within cash along with simply no curiosity or late charges. Right After a 14-day totally free test, Encourage deducts a good $8 subscription payment through your checking accounts each 30 days. If you’re considering applying cash advance applications appropriate together with PayPal, weigh typically the pros and cons.